Self Bill Invoice

One of its benefits is that you dont need to worry about writing an invoice and sending it to. Creating a Self-Billed Invoice.

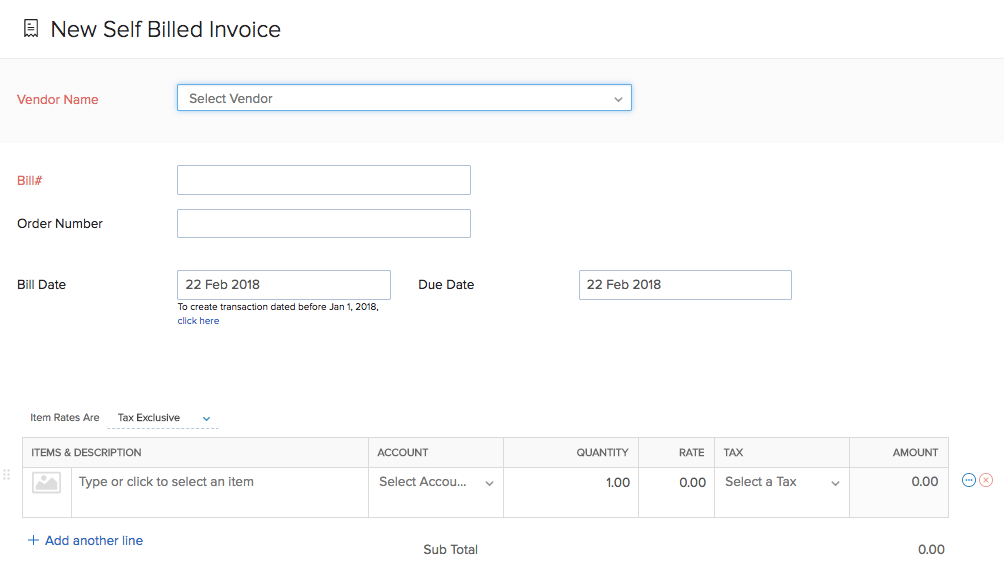

Self Billed Invoices User Guide Zoho Inventory

Once the purchase order is approved you can then email or print and send it to your supplier.

. Click Create Self Billed. Ad Send Customized Invoices Easily Track Expenses More. Look Professional - Make a good impression with this clear and intuitive invoice.

Ad Free Invoice Template for small businesses designed to increase sales. Ad Send Customized Invoices Easily Track Expenses More. Enter a self-billing invoice.

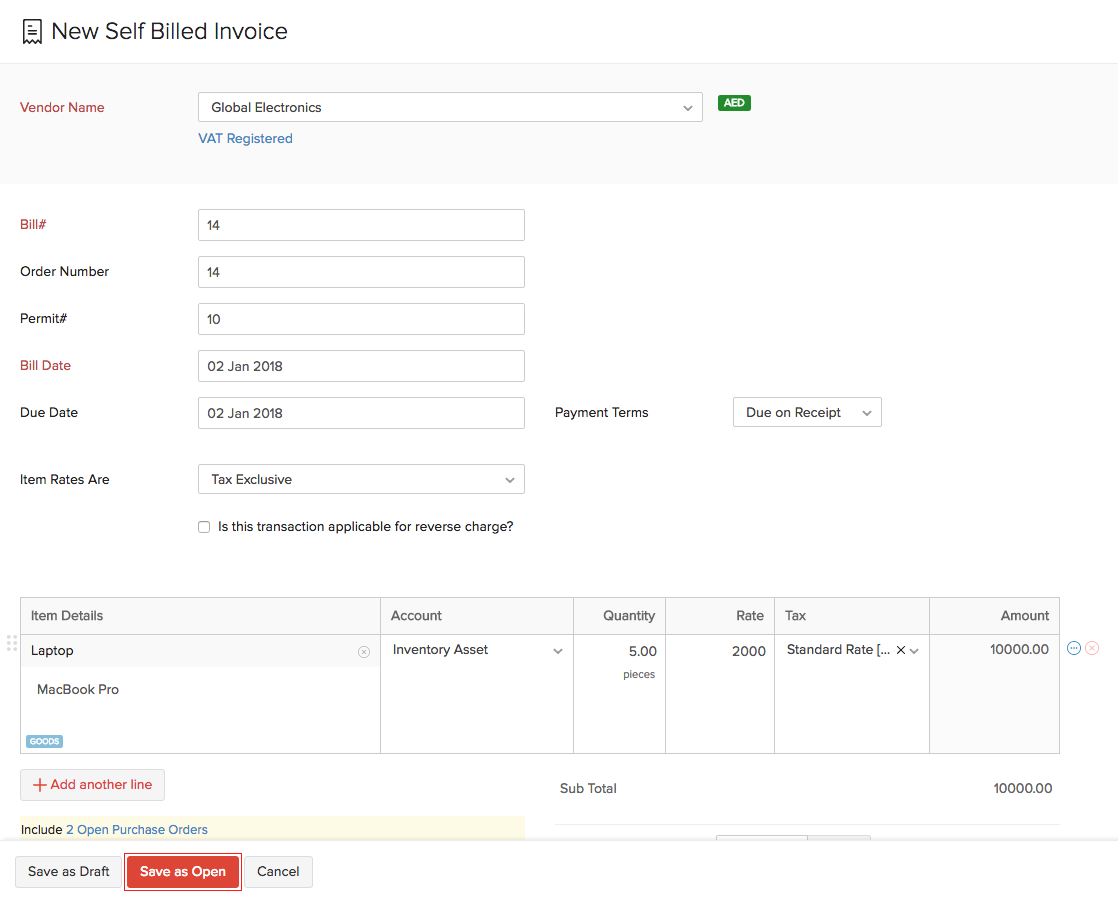

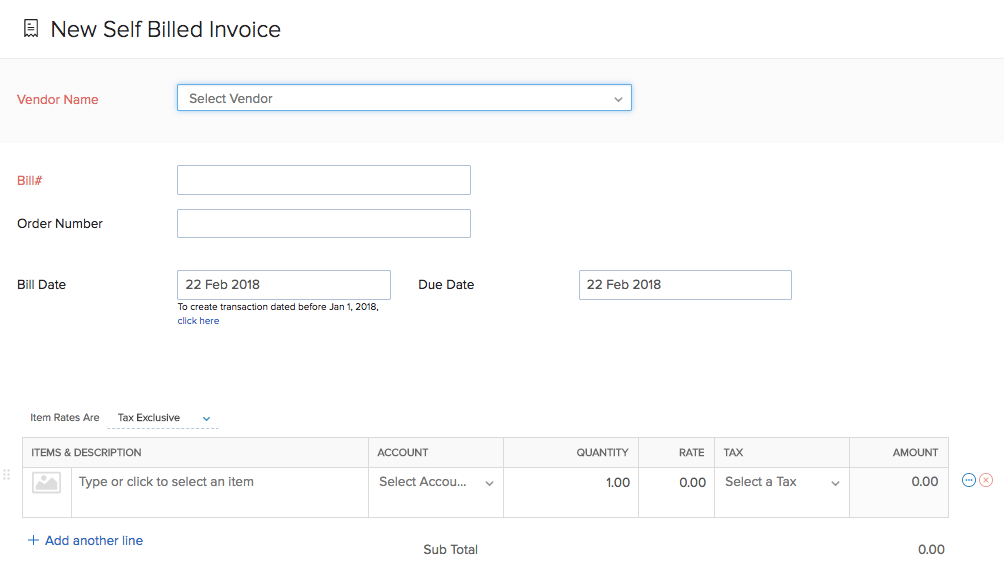

Easy-to-use and professionally designed these free invoice templates streamline your administrative time so you can get back to running your business. For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. To create a self-billed invoice.

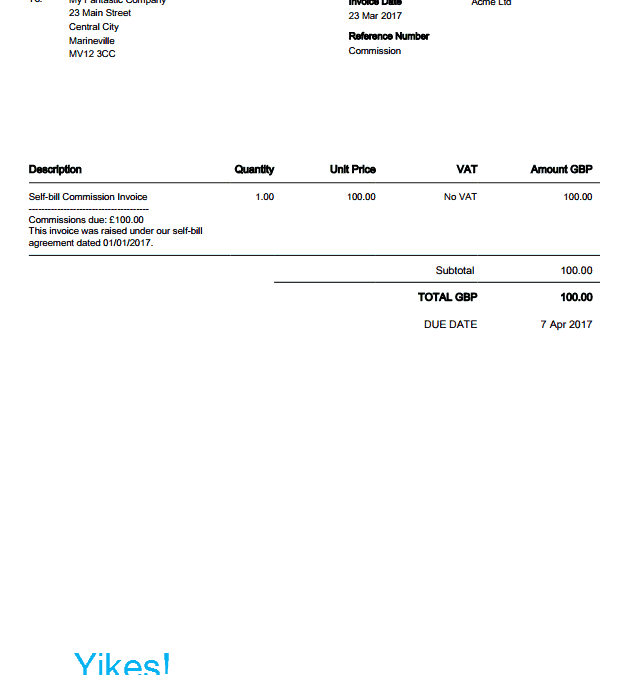

You can find self-billing invoices of your payments in your Awin account under Reports Payment History. In the Vendor account field click the drop-down button to open the lookup. A self-billing arrangement is an agreement between a supplier and their customer.

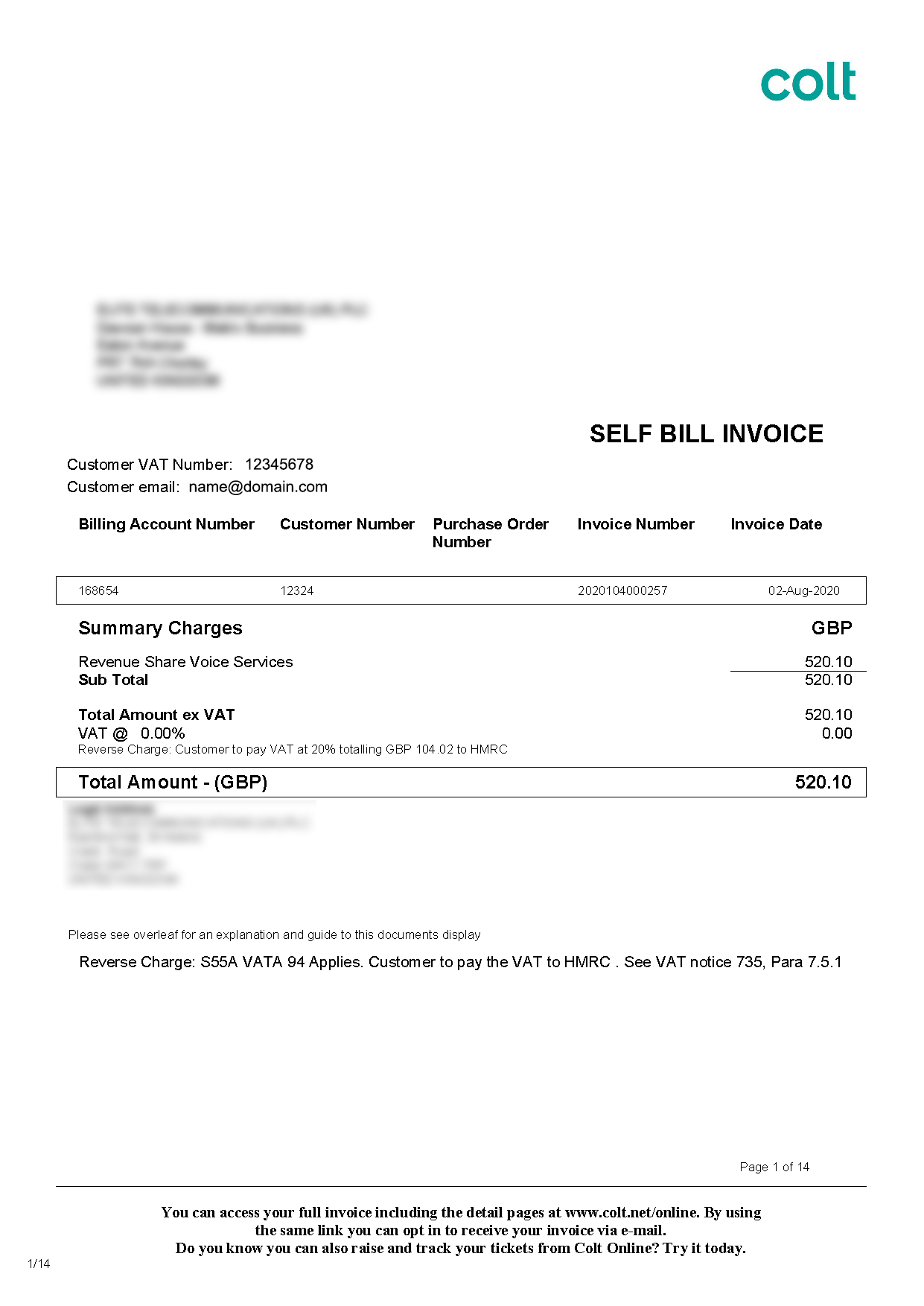

Efficient Apps Trusted Brands. SELF BILLED INVOICE. The supplier accounts for VAT even if the self bill invoice is not raised for the same or the bill.

The self bill invoice should account for the goods or services sold and the VAT applied on them. Ad Ensure Accuracy And Compliance And Make Your Accountant Happy. Click Bills on the sidebar.

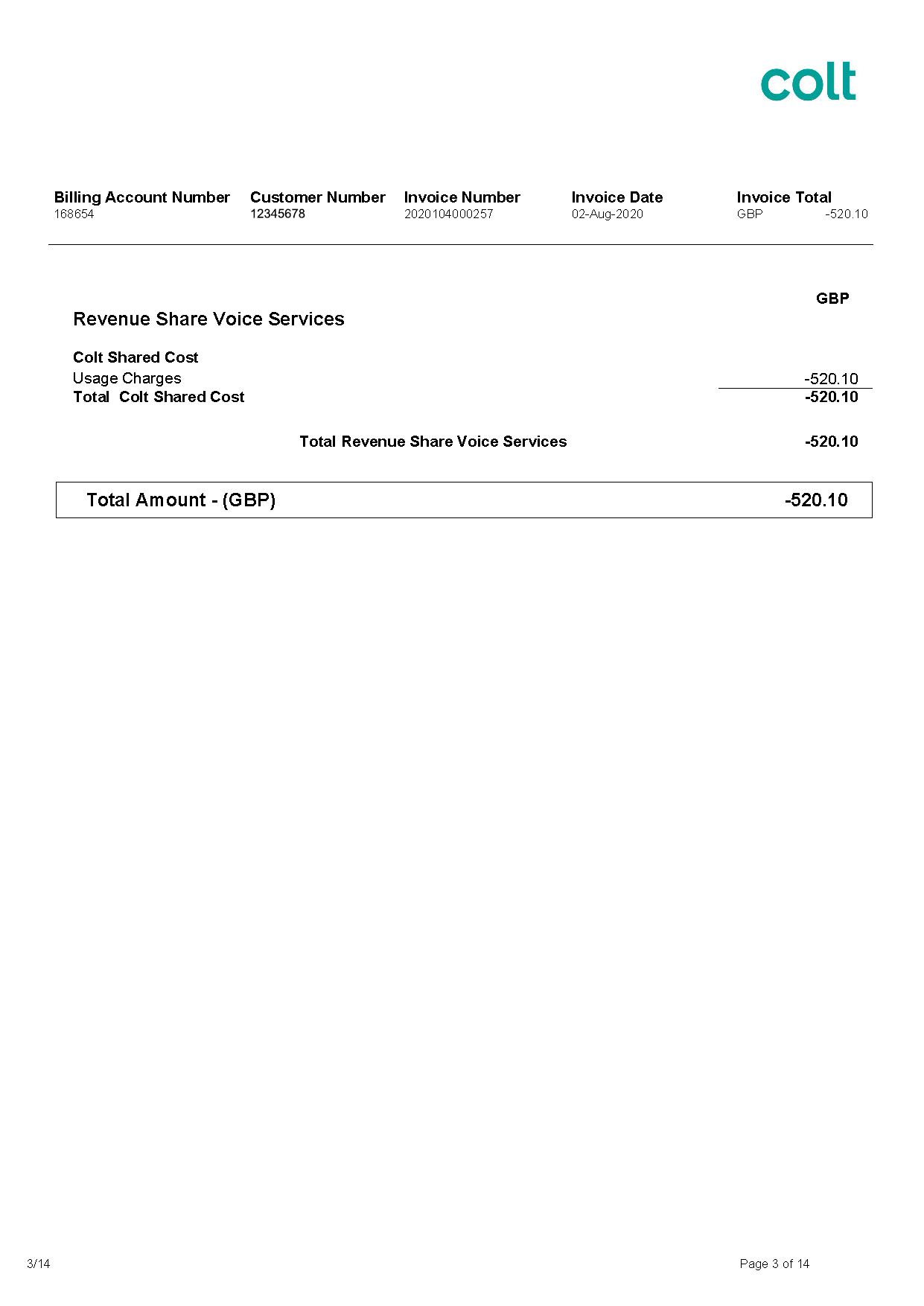

Create a purchase order and apply the self-billing invoice theme. Get Paid Easier Faster. The self bill invoice shows the transactions ie the new purchases and renewals which occurred in a calendar month.

Try For Free For 30 Days. Means the invoice produced via the Application on the Suppliers behalf through which the Technology Provider shall process payment Self-Billing Agreement means. Click the drop-down next to New button on the top-right corner of the page.

Print Self-billed invoice. Go to Accounts payable Purchase orders All purchase orders. The customer prepares the suppliers invoice and.

Try Easy-To-Use Double-Entry Accounting Tools With FreshBooks. Get It Right The First time With Sonary Intelligent Software Recommendations. The notional tax point is the day after the date the self-bill invoice was issued.

The values shown in the self bill invoice reflect the full. The following table lists the possible combinations of header action codes item action codes and the corresponding processing flow. Ad Compare Try The Best Online Invoice Software Get a Free Trial.

The Payment Report shows the processing date period payment method and. Selfbilling is a commercial arrangement between a supplier and a customer in which the customer prepares the suppliers invoice and forwards a. Both customer and supplier must be VAT registered.

Self-billing is the opposite of List Billing in that the company creates their own invoice and sends that to the carrier with payment. Or for example in an animal feed industry were truck loads of multilple tonnes are very different in the origin and destination points. Information for self-billees suppliers 61 Identifying customers that are intending to self-bill.

Self-billing is most commonly seen in Life. For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. Excel and Word templates.

Self-billing is an arrangement between a supplier and a customer. Ad Create and Manage Customized Invoices Online. Find The Best Online Invoice Software Get a Free Trial.

Self Bill Invoice Example Caseron Cloud Accounting

Self Billed Invoices Colt Technology Services

Self Billed Invoices Colt Technology Services

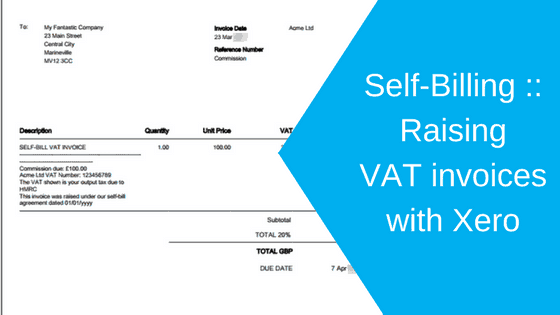

Self Billing Raising Vat Invoices With Xero Caseron Cloud Accounting

Creating A Self Bill Invoice On Behalf Of Your Artist Curve Royalty Systems Knowledge Base